à la carte services

Full Credit Analysis and Audit

$30.00

Inquiry Deletion

$40.00

Full Credit Analysis and Audit

$30.00

Collection / Charge Off Deletion

$300.00

Late Payment Deletion

$300.00

Reposession Removal

$400.00

Business/ Personal Credit Consultation

$500/30 minutes

Child Support Removal

$750.00

Bankruptcy Removal

$1,000.00

FAQ’s for FUNDING

What percentage do you charge for the total amount acquired?

We structure by rounds. For 1 round, which is typically a 30 days process , we charge 15%. For 2 rounds, typically a 60 day process, we charge 12%. Lastly for 3 rounds, typically a 90 day process, we charge 10%.

Why is funding important?

Funding provides the necessary capital at a fast pace to invest, which might’ve taken years and countless hours of hard work to “save”. Funding gives you the opportunity to invest in the business you always wanted to start or to grow and scale your current business.

Isn't this debt?

YES, credit is not free money. It’s the bank’s money which needs to be paid back. However, when managed responsibly, positive debt is a powerful tool for growth and investment which opens doors and opportunities we would’ve worked all our life to reach.

Can I get funding with bad credit? Having negative items on my file?

We highly recommend against this. This is only an option for high level funding such as equipment financing for experienced business owners. For someone new to credit and business and are looking for traditional funding (capital stacking) it’s a hard NO.

What information/ documents would be needed to apply?

Documents needed would be:

Identification Documents (ID/SSN/Passport)

Proof Of Address

Credit Reports

Paystubs/ Bank Statements

Tax Returns/ P&Ls if applicable

Is this on the personal side or business?

We offer both personal and business funding options. The type of funding that is best for you depends on your specific needs and circumstances.

Can I get funding for a brand new business?

Yes, we’ve funded hundreds of thousands for new businesses, as it will come down to your personal credit as you will be personally guaranteeing the business.(PG)

My business isn't structured properly. Can I still qualify for funding?

Yes, you could possibly still qualify for funding but we would help restructure the business or even just create a new one to improve your fundability and maximize the amount of capital acquired.

What are the interest rates on the products?

Interest rates vary widely depending on the type of funding, the specific banks, your credit profile, and market conditions but we like to focus on 0% products.

Are there risks in getting funding that I should be aware of?

Of course. Which is why we don’t want to fund just anybody, we gauge the person’s seriousness, level of experience, and plan they have for the capital. The obligation to repay and possibility of over-leveraging are definitely risks to keep in mind.

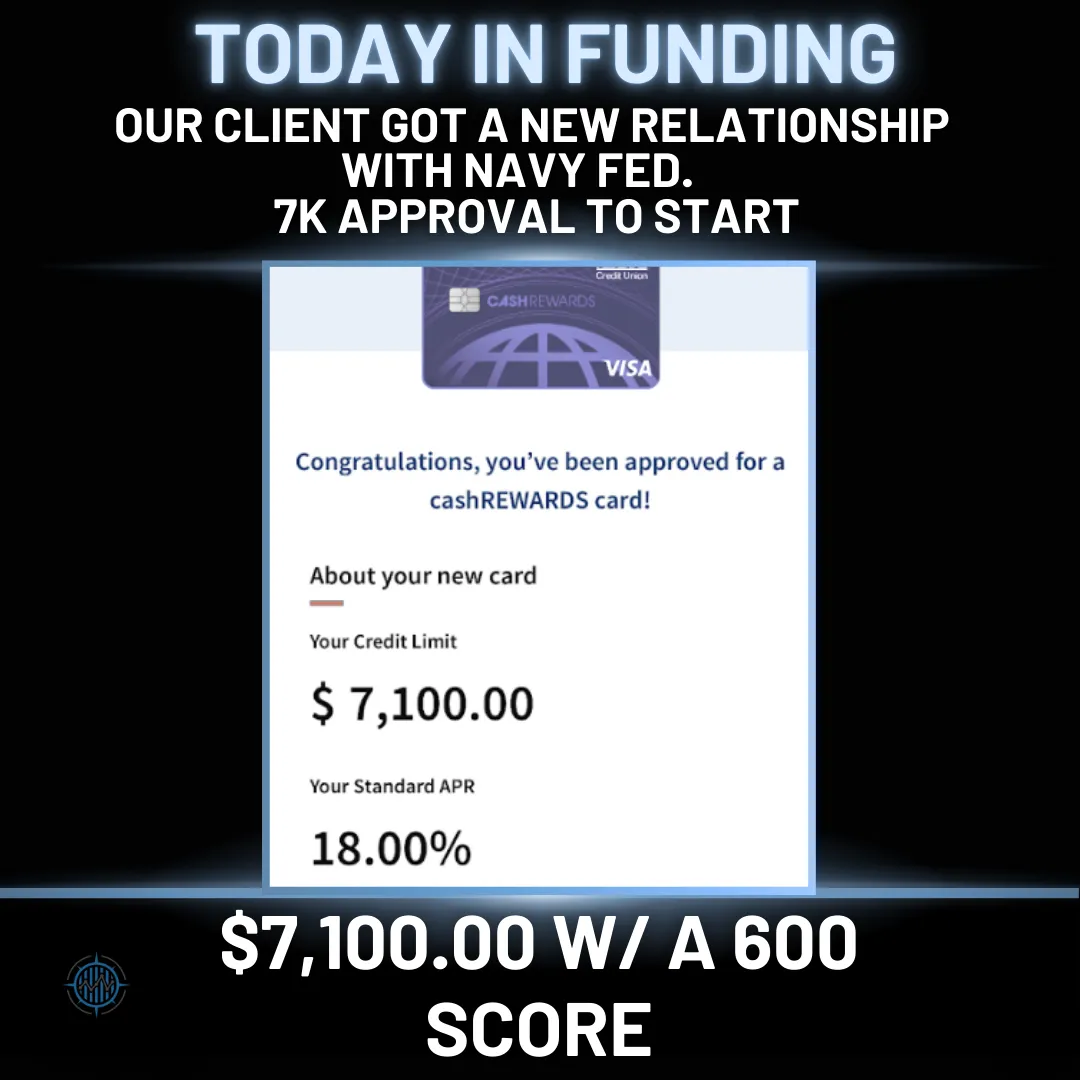

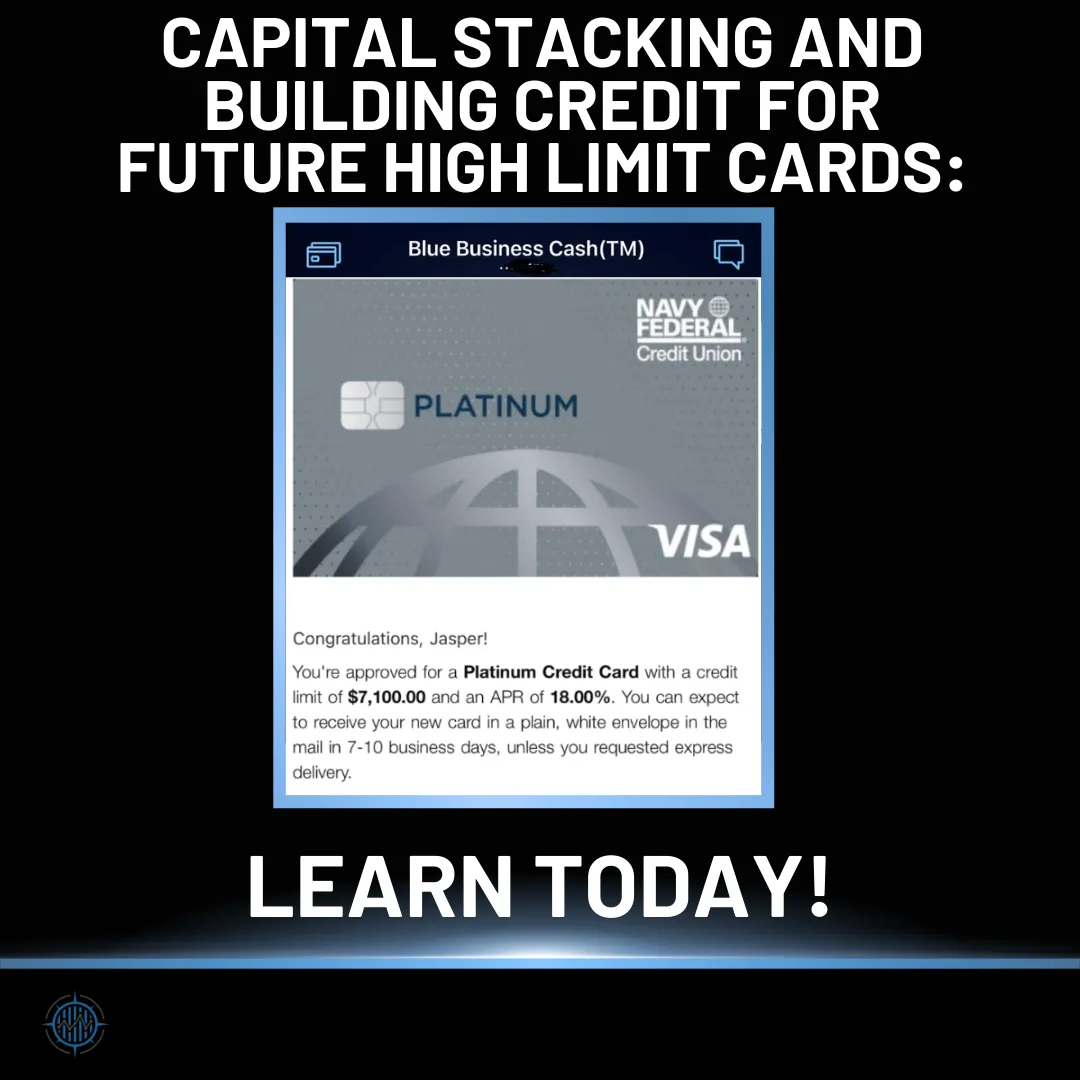

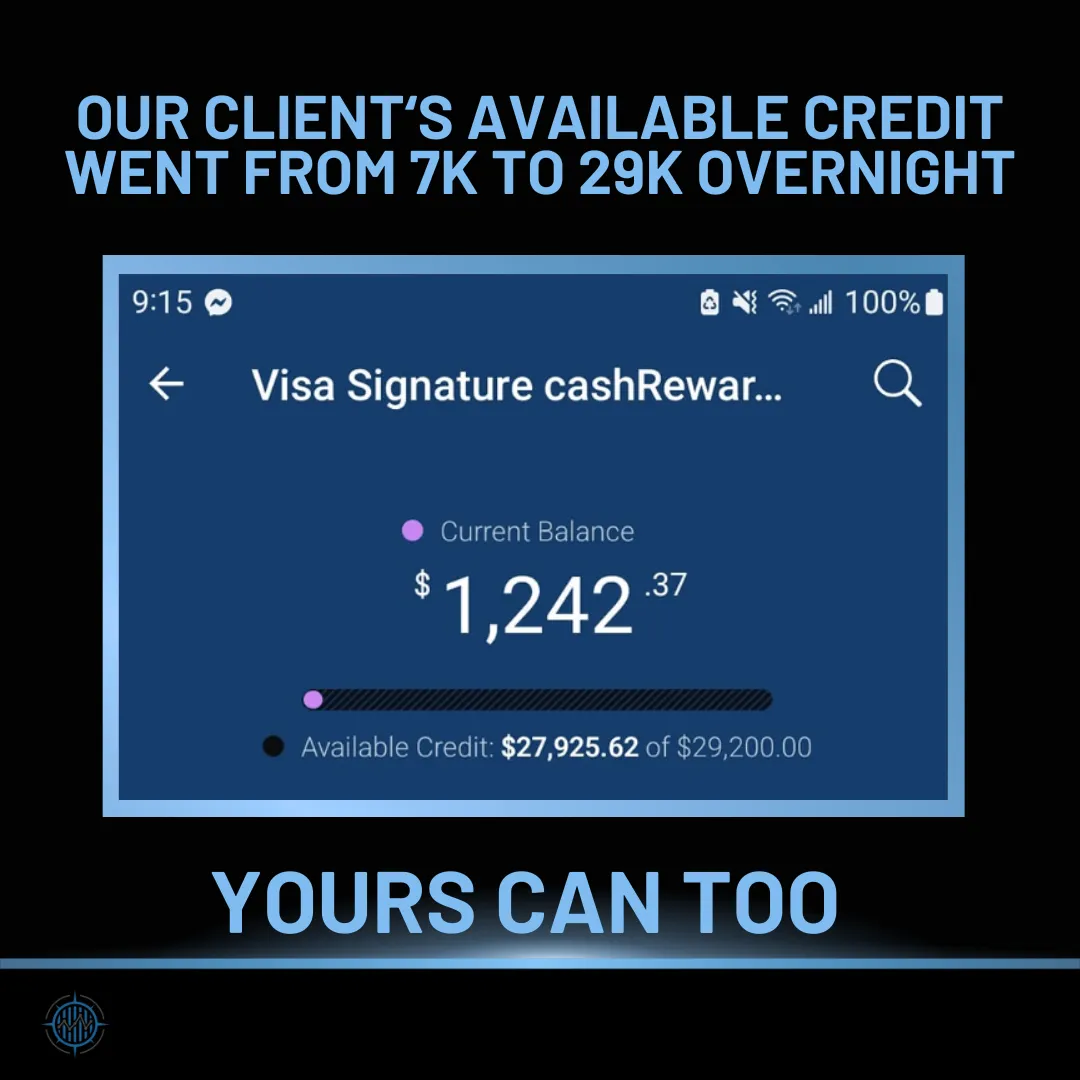

Funding Results

Services We Offer

Credit Restoration

Credit Building

Personal Funding

Business Funding

Real Estate Acquisition Coaching

Business Acquisition Coaching

A-Z Business Creation

Business Consulting

We Guarantee Results or Your Money Back

© 2026, by Crossroads Solutions